Many happy returns Board member Lee Foster’s guidance generates marked growth.

Pittsburgh Foundation board member Lee B. Foster II learned about investing and business on the job at L. B. Foster Co., which his father founded in 1902 to provide rail transportation to mines, logging camps and quarries. It’s now a publicly traded global company. (Photo credit: Joshua Franzos).

Since 2013, when Lee B. Foster II joined The Pittsburgh Foundation’s Board, he has invested himself in increasing the Foundation’s financial power to do great things. The result: Assets under management as well as dollars for grantmaking rose significantly.

This is a testament to Foster’s astute guidance as chair of the Investment Committee, a role he has held from 2017 to the present. He also served on the Audit and Finance committees through 2021.

For community foundations, asset growth isn’t just a measure of wise management of market forces. It translates directly into additional grant-making dollars to benefit the community.

“ Successful alternative investing relies on an experienced and skilled investment committee and staff. The Pittsburgh Foundation is fortunate to have both, and this will inevitably result in accessing top managers who produce superior results.”

— Lee Foster

During Foster’s tenure, total foundation assets grew from $1.05 billion to $1.45 billion. Over that same period, cumulative grantmaking grew from $700 million in 2013 to $1.1 billion by the end of last year.

Jonathan Brelsford, the Foundation’s senior vice president for Finance and Investments, believes Foster’s calm and insightful leadership was “critical to this growth.” He credits Foster with encouraging the Foundation to explore alternative investments, especially private equity and venture capital, and introducing the Foundation to private capital managers who staff would not have met otherwise.

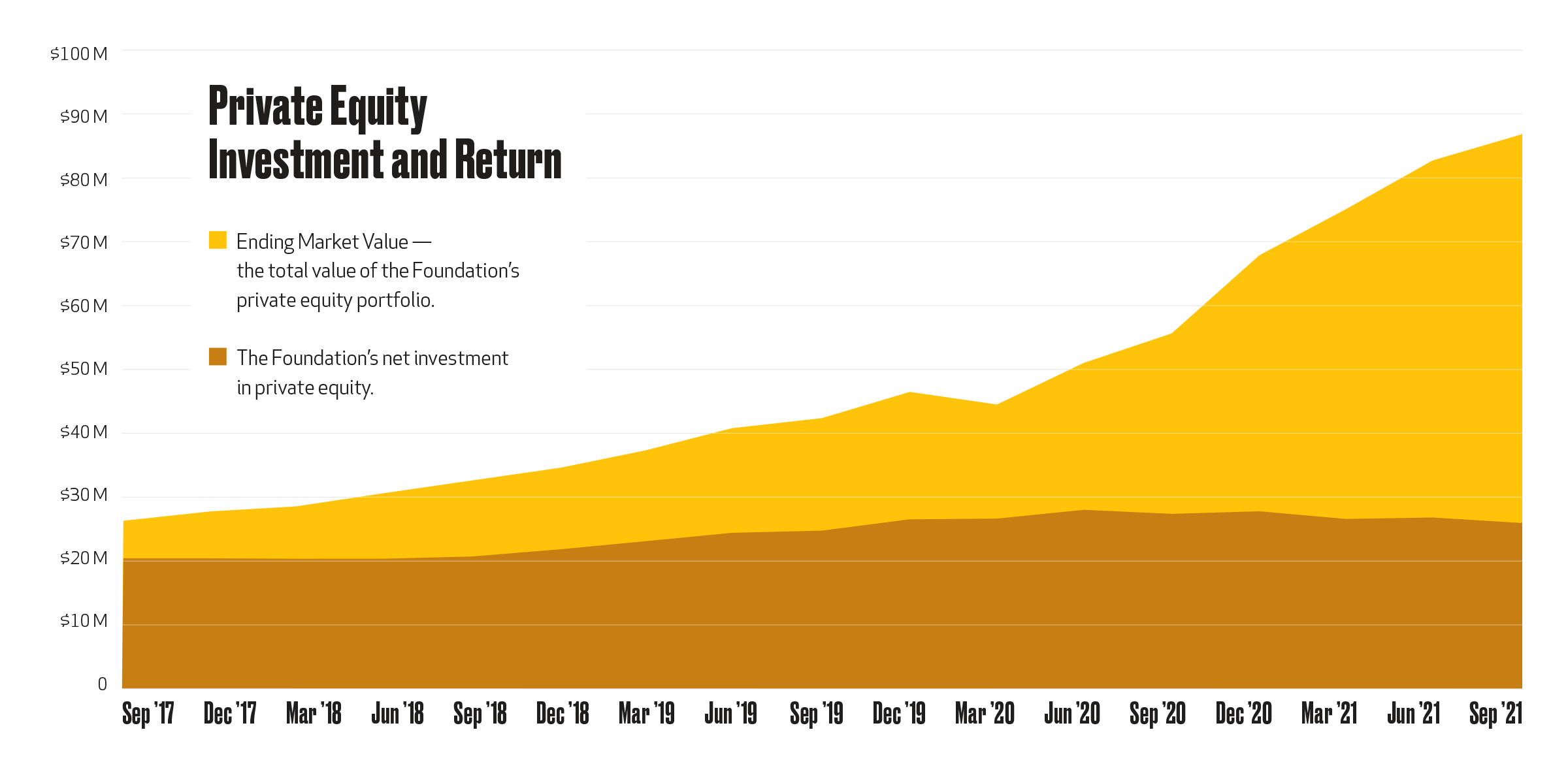

Those introductions paid off. As Foster predicted, investing under the private equity umbrella has delivered higher-than-expected returns.

The Foundation’s return-on-investment goal for private equity is 5% above what is realized in public market investments. But the private equity portfolio’s performance over the past several years has far surpassed that, delivering annualized returns of as much as 10.2%.

With Foster’s encouragement, the Foundation has more than doubled its stake in private equity — from 15% to 35% — and all indications are that the strategy will continue to deliver strong returns in future years.

Beyond advising on investment strategy, Foster has guided significant structural changes in the investment program, including reducing costs by selecting new partners and streamlining processes.

Both of those moves have reduced fees. Legacy Fund charges, for example, have dropped 12 basis points, which translates to a savings of $576,000 per year. The Foundation also increased from three to five the number of investment portfolio options available to donors.

More options mean more opportunities for donors to align their risk-and-growth strategies to their philanthropic intentions.

In addition, Foster has been an ally of the Finance and Investment staffs as they work to increase the diversity of the Foundation’s outside financial managers. The investment industry is overwhelmingly run and staffed by white men despite what Brelsford says is strong evidence that teams with greater diversity in race and gender, as well as those inclusive of people with disabilities, have been shown to provide superior performance.

“By pushing our investment managers to diversify their staffs, we’re looking for positive impact on the portfolio. Also, we want to provide more people with access to an industry that can build wealth for their own families.”

To view additional data and information, read the original story which appeared in the 2021 Report to the Community. | See archive of print publications.