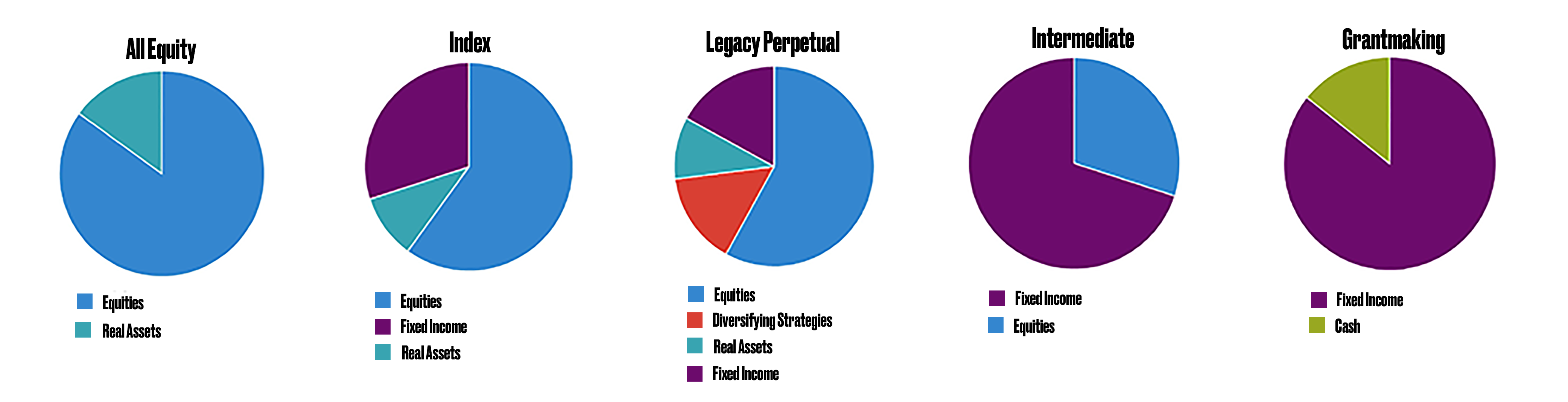

The Legacy Fund Family of investment options are a group of portfolios designed to meet the objectives of our donor’s philanthropic intent. These strategies range from our flagship fund, the Legacy Perpetual Fund, designed for the long-term nature of most of our charitable funds, to the Legacy Grantmaking Fund, a short-term cash management strategy that preserves funds that are slated for grantmaking in the upcoming year.

LEGACY PERPETUAL FUND

The flagship fund of The Pittsburgh Foundation, this is a perpetual investment strategy designed for long-term capital appreciation. It is intended for assets that are permanently invested versus other funds in the Foundation’s family that have more liquidity and shorter time horizons.

| TPF direct investment management fee | 23 basis points |

| Legacy Fund managers' fee | 94 basis points |

| Estimated total fees | 117 basis points |

LEGACY INDEX FUND

Legacy Index Fund is a perpetual investment strategy designed for long term capital appreciation using a passive index approach. This fund consists of Vanguard index mutual funds allocated to mirror the overall allocation of the Legacy Perpetual Fund, but without the Private Equity and Hedge Fund investments, resulting in a more liquid and lower cost portfolio.

| TPF direct investment management fee | 14 basis points |

| Legacy Fund managers' fee | 6 basis points |

| Estimated total fees | 20 basis points |

LEGACY INDEX - ALL EQUITY FUND

This perpetual investment strategy is designed for long-term capital appreciation and uses a passive index approach that consists only of the equity portion of the Legacy Index Fund mentioned above, excluding fixed income investments subject to significantly higher volatility.

| TPF direct investment management fee | 14 basis points |

| Legacy Fund managers' fee | 7 basis points |

| Estimated total fees | 21 basis points |

LEGACY INTERMEDIATE FUND

This intermediate investment strategy is designed for capital preservation for donors who wish to distribute the entirety of their fund over the next three to seven years. It takes a more conservative approach, with a high allocation to fixed income investments targeting significantly lower volatility and return than the Perptual, Index and All-Equity portfolios.

| TPF direct investment management fee | 14 basis points |

| Legacy Fund managers' fee | 27 basis points |

| Estimated total fees | 41 basis points |

LEGACY GRANTMAKING FUND

This fund utilizes a short-term cash management investment strategy designed to protect principal. It contains high quality, short-term bonds for donor funds that are intended to be granted out over the next one to three years.

| TPF direct investment management fee | 14 basis points |

| Legacy Fund managers' fee | 10 basis points |

| Estimated total fees | 24 basis points |

Learn more.

Let our knowledgeable donor services staff guide you through our investment strategies. Call our office at 412-394-2630, or contact us via email:

development [at] pghfdn.org (email us)